2018 was unequivocally the year I started taking our household finances seriously.

I got us set up through the first months of the year with all our accounts in budgeting software called “You Need a Budget” (YNAB) and made a household budget and largely stuck to it.

The YNAB software is great, it is a stellar example of how software can help to shape your behaviour and help you to understand things. Adopting its way of thinking means I think about what I want my money to do, what my expenses are and it helps me to allocate that money for immediate and long-term expenses. It is also a spectacular web application. The best version of the software runs in your browser and works very well.

There are always multiple things to spend money on and the software helps you to figure out how to prioritize spending and saving that money. Being able to get a sense of what your money will be doing and how much you have and are allocating for a given purpose eases the anxiety of otherwise staring blankly at the checking account balance trying to add up the things you know will come out of it and hoping you still have money left when it starts again the next month.

The first and most important thing about our finances right now is getting rid of our consumer debt. (Which for us means any debt that isn’t my student loans or our mortgage.) Though at the start of 2018, I was too ambitious: I thought I’d be able to halve out debt in a year, which I wasn’t able to do. I made a dent, but a number of other things added back some of that debt. We understand where we’re at financially much better at the start of 2019 than we did in 2018. We’re never going to overdraw our checking account again and even as we shovel money into paying down our debts. We’re also earmarking money without consciously saving it. I put $80 a month into a category for our water bill and when we get a water bill every 3 months for about $240, we just cut a check we don’t worry about precisely when to do it.

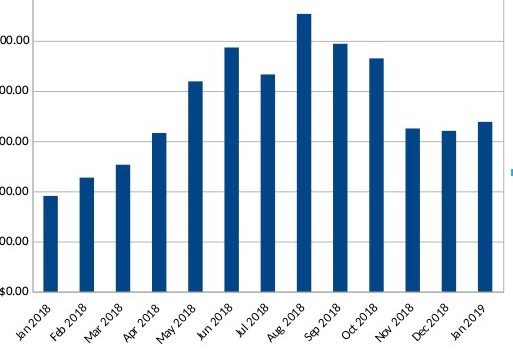

We’ve managed to lower the amount of debt we’re in and mostly stabilize our other accounts. The graph here shows (with redacted totals) the total cash we have (savings and checking accounts minus credit card accounts). We had some setbacks and took on some more debt and spent more cash in 2018 than we could have guessed in January but that’s OK as long as we’re reducing our debt and putting away enough money for other expenses. Even with those setbacks, we’re in a much better place than we were at the start of the year and only going to get into a better place as the year moves on.

All in all, we’re set up to be in pretty good shape here in 2019 to finish paying off those debts. I have a spreadsheet with the plan and YNAB to help me get there. I think we’ll have it all paid off just in time for Chessie and I to celebrate the ten-year anniversary of our first date.

2019 is about getting ourselves all the way out of a hole and onto firm ground. I am hopeful we can carry out this plan to reduce our debt in 2019 and end 2019 in a very good position even as the unexpected happens. (As I write this the car is at the dealership getting a ton work work done which we’d only mostly anticipated and tax season approaches and has typically left us with a large bill…)

My goals in 2018 were:

- Build up a month’s expenses in our main checking account: stop living paycheck to paycheck.

- Add at least 15% to out savings.

- Pay off at least half the outstanding balances on our credit cards & debts.

My goals for 2019 are much the same:

- Have a month of expenses in checking accounts. Spend last month’s money this month. 1

- Pay off our credit cards 100%. 2

- Regular savings contributions, fixed amount per month. 3

There are other more detailed goals I’d like to hit, but I need to ignore those as they’re pretty far outside my control and I’m already going to be hard pressed to meet my savings balance goal with the car repairs I’m having done this week and next. An important part of goals are setting ones it is within my power to achieve and I think these fit that.

- YNAB helps enforce this by having you “budget to 0” which gives each dollar you have something do to, but if you budget more than you have, you’re allocating money you haven’t received, you’ll have negative money “to be budgeted” which is the situation I’m in now.

- Currently forecast to be paid off by November 1, but we’ll see how the year goes.

- Instead of a precise goal, I’ve already dipped into my savings for car repairs in 2019 and shouldn’t punish myself for having to do so, just work to avoid having to do so every time I bring the car into the shop.